How AI is Transforming Risk Management in Trading Strategy Design

In 2025, as traders navigate volatile markets and tighter risk environments, one theme has risen to the forefront: smart risk management. While returns often steal the spotlight, risk control is what truly sustains long-term success. What’s more exciting? AI-powered tools are now playing a critical role in helping traders implement effective risk rules directly into their Pine Script strategies—without manual coding.

Let’s explore how AI is reshaping the way traders think about, implement, and automate risk management.

Why Risk Management Is More Important Than Ever

The financial landscape in 2025 is defined by:

-

Increased volatility in global markets

-

Faster-moving data and market reactions

-

More retail traders entering the space with limited professional experience

All these factors have made effective risk management not just optional, but essential. Poorly managed trades can wipe out portfolios, especially in high-leverage environments.

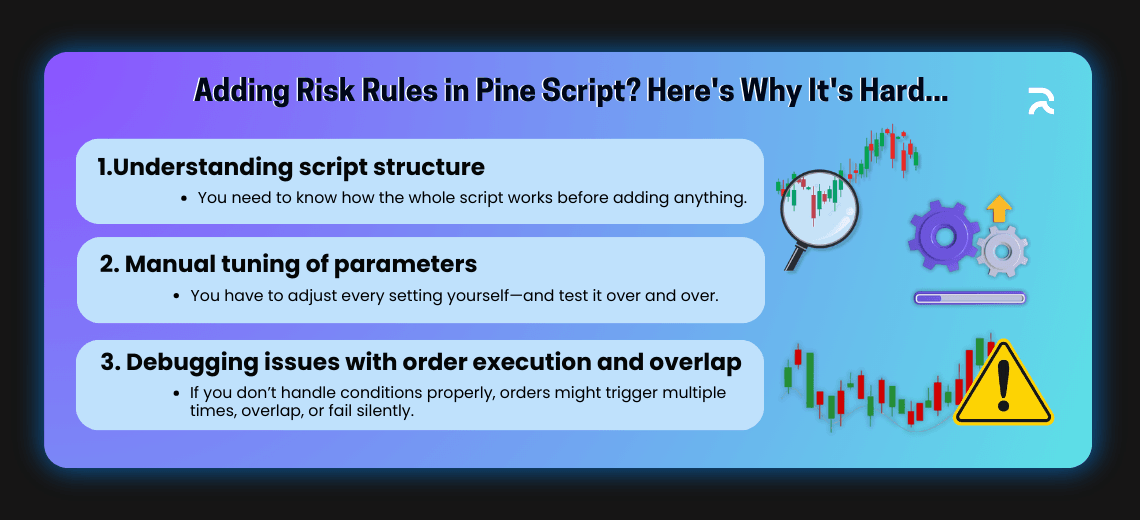

Traditional Challenges of Implementing Risk Rules

In Pine Script, adding proper stop-loss, take-profit, or position-sizing logic can be tedious and requires:

-

Deep understanding of script structure

-

Manual tuning of parameters

-

Debugging issues with order execution and overlap

This creates a major barrier for non-developers who want to enforce strict risk management in their strategies.

How AI-Powered Tools Solve This

With tools like Pine Script AI, traders no longer need to write complex conditions to manage risk. They simply type prompts like:

"Create a strategy with 1% fixed risk per trade and a 2:1 reward-to-risk ratio."

The AI interprets this and builds the necessary framework into the Pine Script code—automatically calculating risk per position and adjusting stop-loss levels dynamically.

This unlocks a new level of control and flexibility, even for users who don’t write a single line of code.

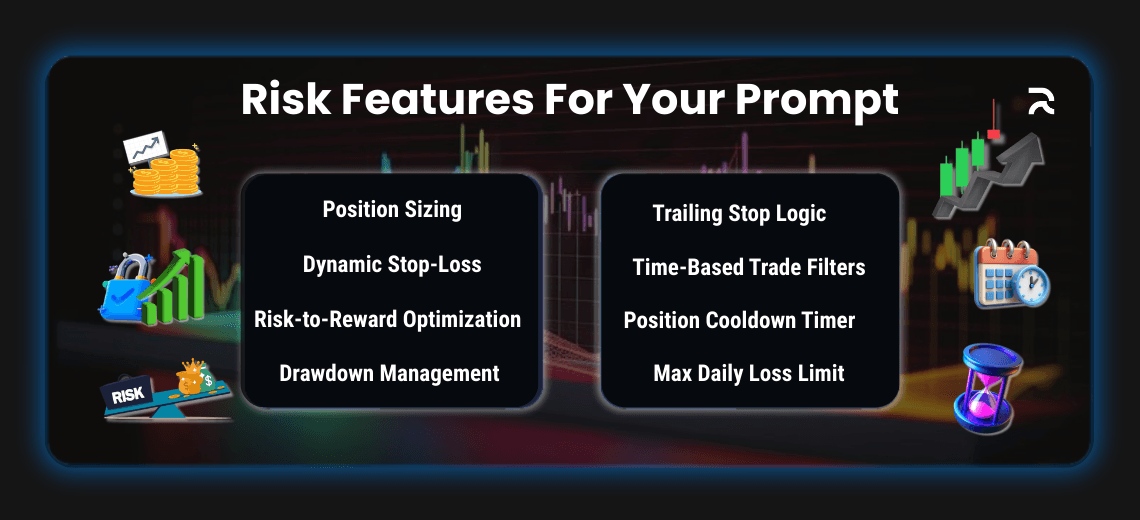

Key Risk Features You Can Now Implement with a Prompt

- Position Sizing – Based on account balance, fixed dollar amount, or percentage risk

- Dynamic Stop-Loss – ATR-based, volatility-based, or previous low/high

- Risk-to-Reward Optimization – Setting reward levels in proportion to risk

- Drawdown Management – Pausing trading after a series of losses

All of this can now be embedded into strategy prompts, reducing both coding time and human error.

Final Thoughts

Risk management used to be the most complex part of strategy development. Thanks to AI, it’s becoming one of the simplest. If you're serious about trading longevity, it's time to treat risk controls as core features—not afterthoughts. Pine Script AI makes it easy to create strategies that protect your capital as aggressively as they pursue returns. Explore how at Pine Script AI.